UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | ||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Pursuant to §240.14a-12 | ||

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| NOTICE OF | ||||

| ANNUAL MEETING | ||||

| AND PROXY STATEMENT |  | |||

| April | ||||

Dear Shareholder:

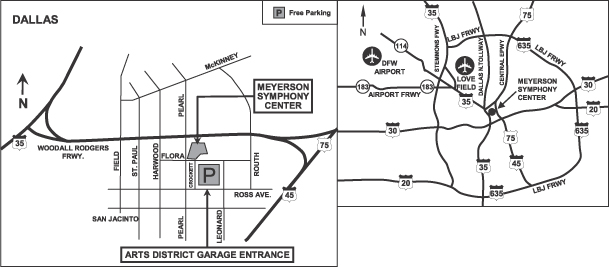

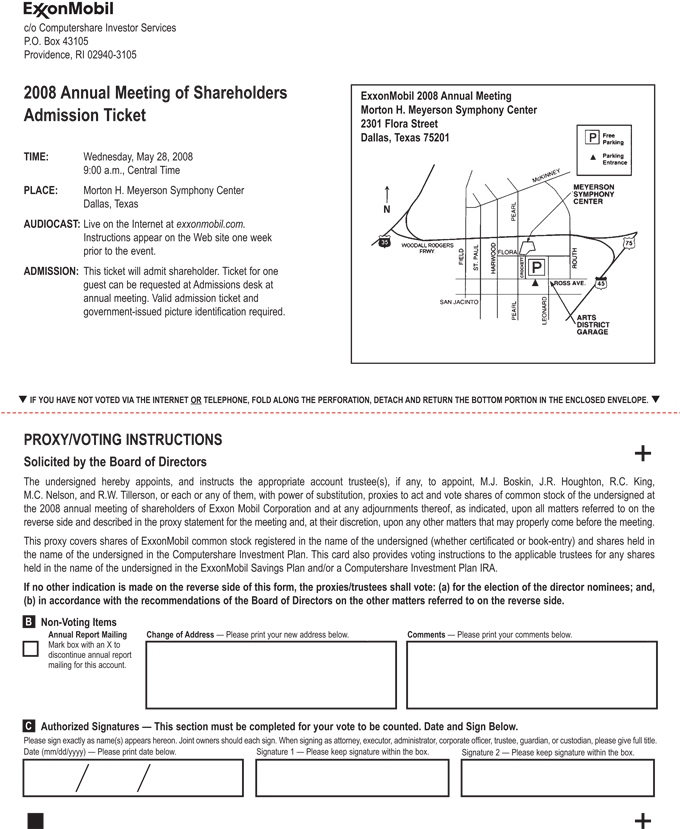

We invite you to attend the annual meeting of shareholders on Wednesday, May 28, 2008,27, 2009, at the Morton H. Meyerson Symphony Center, 2301 Flora Street, Dallas, Texas 75201. The meeting will begin promptly at 9:00 a.m., Central Time. At the meeting, you will hear a report on our business and vote on the following items:

| Ÿ | Election of directors; |

| Ÿ | Ratification of PricewaterhouseCoopers LLP as independent auditors; |

| Ÿ |

|

| Ÿ | Other matters if properly raised. |

Only shareholders of record on April 4, 2008,6, 2009, or their proxy holders may vote at the meeting. Attendance at the meeting is limited to shareholders or their proxy holders and ExxonMobil’sExxonMobil guests. Only shareholders or their valid proxy holders may address the meeting.

This booklet includes the formal notice of the meeting, proxy statement, and financial statements. The proxy statement tells you about the agenda, procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives information about our director candidates, and provides information about the other items of business to be conducted at the meeting.

Even if you own only a few shares, we want your shares to be represented at the meeting. You can vote your shares by Internet, toll-free telephone call, or proxy card.

To attend the meeting in person, please follow the instructions on page 3.3. A live audiocast of the meeting and a report on the meeting will be available on our Web site atexxonmobil.com.

Sincerely,

|  | |||

| Rex W. Tillerson | ||||

| Secretary | Chairman of the Board |

| Page | ||

| 1 | ||

| 4 | ||

| 4 | ||

| 18 | ||

| 19 | ||

Item 4 – | ||

Item 7 – Shareholder Advisory Vote on Executive Compensation | ||

| 60 | ||

Item | 63 | |

Item | 65 | |

Item | 66 | |

| 68 | ||

| A1 | ||

Who May Vote

Shareholders of ExxonMobil, as recorded in our stock register on April 4, 2008,6, 2009, may vote at the meeting.

How to Vote

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to beBe Held on May 28, 2008.27, 2009.

| Ÿ | The |

Electronic Delivery of Proxy Statement and Annual Report

Instead of receiving future copies of these documents by mail, shareholders can elect to receive an e-mail that will provide electronic links to them.the proxy materials. Opting to receive your proxy materials online will save the Company the cost of producing and mailing documents to your home or business, and will also will give you an electronic link to the proxy voting site.

| Ÿ | Shareholders of Record: If you vote on the Internet atwww.investorvote.com/exxonmobil,simply follow the prompts for enrolling in the electronic proxy delivery service. You |

| Ÿ | Beneficial Shareholders: If you hold your shares in a brokerage account, you may also |

How Proxies Work

ExxonMobil’s Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against the other proposals, or abstain from voting.

If your shares are held in your name, you can vote by proxy in one of three convenient ways:

| Ÿ | Via Internet: Go towww.investorvote.com/exxonmobiland follow the instructions. You will need to have your proxy card in hand. At this Web site, you can elect to access future proxy statements and annual reports via the Internet. |

| Ÿ | By Telephone: Call toll-free 1-800-652-8683 |

| Ÿ | In Writing: Complete, sign, date, and return your proxy card in the enclosed envelope. |

Your proxy card covers all shares registered in your name and shares held in your Computershare Investment Plan account. If you own shares in the ExxonMobil Savings Plan for employees and retirees, your proxy card also covers those shares.

If you give us your signed proxy but do not specify how to vote, we will vote your shares in favor of our director candidates; in favor of the ratification of the appointment of independent auditors; and against the shareholder proposals.

If you hold shares through someone else, such as a stockbroker, you will receive material from that firm asking how you want to vote. Check the voting form used by that firm to see if it offers Internet or telephone voting.

Voting Shares in the ExxonMobil Savings Plan

The trustee of the ExxonMobil Savings Plan will vote Plan shares as participants direct. To the extent participants do not give instructions, the trustee will vote shares as it thinks best. The proxy card serves to give voting instructions to the trustee.

Revoking a Proxy

You may revoke your proxy before it is voted at the meeting by:

| Ÿ | Submitting a new proxy with a later date via a proxy card, the Internet, or by telephone; |

| Ÿ | Notifying ExxonMobil’s Secretary in writing before the meeting; or, |

| Ÿ | Voting in person at the meeting. |

Confidential Voting

Independent inspectors count the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card will be sent to us if you write comments on the card.

Quorum

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Treasury shares, which are shares owned by ExxonMobil itself, are not voted and do not count for this purpose.

Votes Required

| Ÿ | Election of Directors Proposal: A plurality of the votes cast is required for the election of directors. This means that the director nominee with the most votes for a particular seat is elected for that seat. Only votes FOR or WITHHELD count. Abstentions are not counted for purposes of the election of directors. |

Our Corporate Governance Guidelines, which can be found in the Corporate Governance section of our Web site atexxonmobil.com/governance, state that all directors will stand for election at the annual meeting of shareholders. In any non-contested election of directors, any director nominee who receives a greater number of votes WITHHELD from his or her election than votes FOR such election shall tender his or her resignation. Within 90 days after certification of the election results, the Board of Directors will decide, through a process managed by the Board Affairs Committee and excluding the nominee in question, whether to accept the resignation. Absent a compelling reason for the director to remain on the Board, the Board shall accept the resignation. The Board will promptly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation on Form 8-K filed with the Securities and Exchange Commission (SEC).

| Ÿ | Other Proposals: Approval of the Ratification of Independent Auditors proposal and the shareholder proposals requires the favorable vote of a majority of the votes cast. Only votes FOR or AGAINST these proposals count. Abstentions and broker non-votes count for quorum purposes, but not for the voting of these proposals. A “broker non-vote” occurs when a bank, broker, or other |

holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. |

Annual Meeting Admission

Only shareholders or their proxy holders and ExxonMobil’sExxonMobil guests may attend the meeting.For safety and security reasons, no cameras, camera phones, recording equipment, electronic devices, large bags, briefcases, or packages will not be permitted in the meeting. In addition each shareholder and ExxonMobil’sExxonMobil guest will be asked to present a valid government-issued picture identification, such as a driver’s license, before being admitted to the meeting.

For registered shareholders, an admission ticket is attached to your proxy card. Please detach and bring the admission ticket with you to the meeting.

If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 4, 2008,6, 2009, the record date for voting. You may receive an admission ticket in advance by sending a written request with proof of ownership to the address listed under “Contact Information” below.

Shareholders who do not present admission tickets at the meeting will be admitted only upon verification of ownership at the admission counter.

Audiocast of the Annual Meeting

You are invited to visit our Web site atexxonmobil.com to hear the live audiocast of the meeting at 9:00 a.m., Central Time, on Wednesday, May 28, 2008.27, 2009. An archived copy of this audiocast will be available on our Web site for one year.

Conduct of the Meeting

The Chairman has broad responsibility and legal authority to conduct the annual meeting in an orderly and timely manner. This authority includes establishing rules for shareholders who wish to address the meeting. Only shareholders or their valid proxy holders may address the meeting. Copies of these rules will be available at the meeting. The Chairman may also exercise broad discretion in recognizing shareholders who wish to speak and in determining the extent of discussion on each item of business. In light of the number of business items on this year’s agenda and the need to conclude the meeting within a reasonable period of time, we cannot assure that every shareholder who wishes to speak on an item of business will be able to do so.

Dialogue can be better be accomplished with interested parties outside the meeting and, for this purpose, we have provided a method for raising issues and contacting the non-employee directors either in writing or electronically on our Web site atexxonmobil.com/directors. The Chairman may also rely on applicable law regarding disruptions or disorderly conduct to ensure that the meeting is conducted in a manner that is fair to all shareholders. Shareholders making comments during the meeting must do so in English so that the majority of shareholders present can understand what is being said.

Contact Information

If you have questions or need more information about the annual meeting, write to:

Mr. Henry H. HubbleDavid S. Rosenthal

Secretary

Exxon Mobil Corporation

5959 Las Colinas Boulevard

Irving, TX 75039-2298

call us at 1-972-444-1157,

or send a fax to us at 1-972-444-1505.

For information about shares registered in your name or your Computershare Investment Plan account, call ExxonMobil Shareholder Services at 1-800-252-1800 (within the United States, Canada, and Puerto Rico), or 1-781-575-2058 (outside the United States, Canada, and Puerto Rico), or access your account via the Web site atcomputershare.com/www.computershare.com/exxonmobil. We also invite you to visit ExxonMobil’s Web site atexxonmobil.com. Investor information can be found atexxonmobil.com/investor. Web site materials are not part of this proxy solicitation.

Overview

The Board of Directors and its committees perform a number of functions for ExxonMobil and its shareholders, including:

| Ÿ | Overseeing the management of the Company on your behalf; |

| Ÿ | Reviewing ExxonMobil’s long-term strategic plans; |

| Ÿ | Exercising direct decision-making authority in key areas, such as declaring dividends; |

| Ÿ | Selecting the CEO and evaluating the CEO’s performance; and, |

| Ÿ | Reviewing development and succession plans for ExxonMobil’s top executives. |

The Board has adopted Corporate Governance Guidelines that govern the structure and functioning of the Board and set out the Board’s position on a number of governance issues. A copy of our current Corporate Governance Guidelines is posted on our Web site atexxonmobil.com/governance.The Guidelines are also available to any shareholder on request to the Secretary at the address given under “Contact Information” on page 3.

All ExxonMobil directors stand for election at the annual meeting. Non-employee directors cannot stand for election after they have reached age 72, unless the Board makes an exception on a case-by-case basis. Employee directors resign from the Board when they are no longer employed by ExxonMobil.

Director Independence

Our Corporate Governance Guidelines require that a substantial majority of the Board consist of independent directors. In general the Guidelines require that an independent director must have no material relationship with ExxonMobil, directly or indirectly, except as a director. The Board determines independence on the basis of the standards specified by the New York Stock Exchange (NYSE);, the additional categorical standards referenced in our Corporate Governance Guidelines;Guidelines, and other facts and circumstances the Board considers relevant.

The NYSE standards generally provide that a director will not be independent if: (1) the director is, or in the past three years has been, an employee of ExxonMobil; or a member of the director’s immediate family is, or in the past three years has been, an executive officer of ExxonMobil; (2) the director or a member of the director’s immediate family has received more than $100,000$120,000 per year in direct compensation from ExxonMobil other than for service as a director; (3) the director is a current partner or a member of the director’semployee, or an immediate family currentlymember is a current partner, of PricewaterhouseCoopers LLP (PwC), our independent auditors; or an immediate family member is a current employee in PwC’s audit, assurance, or tax compliance practices;of PwC and personally works on ExxonMobil’s audit; or within the past three years the director or an immediate family member has been a PwC partner or employee who worked on ExxonMobil’s audit; (4) the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where an ExxonMobil executive officer serves on the compensation committee; or, (5) the director or a member of the director’s immediate family is an executive officer of a company that

company that makes payments to, or receives payments from, ExxonMobil in an amount which, in any 12-month period during the past three years, exceeds the greater of $1 million or 2 percent of that other company’s consolidated gross revenues.

ExxonMobil’s Corporate Governance Guidelines also provide that a director will not be independent if a reportable “related person transaction” exists with respect to that director or a member of the director’s family for the current or most recently completed fiscal year. See the Guidelines for Review of Related Person Transactions posted on the Corporate Governance section of our Web site and described in more detail under “Related Person Transactions and Procedures” below.on pages 11-12. The categorical standards provided in the Related Person Transaction Guidelines also serve as ExxonMobil’s additional categorical standards for determining director independence.

The Board has reviewed relevant relationships between ExxonMobil and each non-employee director and director nominee to determine compliance with the NYSE standards and ExxonMobil’s additional categorical standards. The Board has also evaluated whether there are any other facts or circumstances that might impair a director’s independence. Based on that review, the Board has determined that all ExxonMobil non-employee directors and director nominees (M.J. Boskin, L.R. Faulkner, K.C. Frazier, W.W. George, J.R. Houghton, W.R. Howell, R.C. King, P.E. Lippincott, M.C. Nelson, S.J. Palmisano, S.S Reinemund, W.V. Shipley, and E.E. Whitacre, Jr.) are independent. The Board has also determined that each member of the Audit, Board Affairs, Compensation, and CompensationPublic Issues and Contributions Committees (see membership table below) is independent.

In recommending that each director and nominee be found independent, the Board Affairs Committee reviewed the following transactions, relationships, or arrangements. All matters described below fall within the NYSE and ExxonMobil independence standards.

| Name | Matters Considered | |

K.C. Frazier | Ordinary course business with Merck (purchases of pharmaceutical products; sales of chemicals and oils) | |

M.C. Nelson | Ordinary course business with Carlson (purchases of travel services; sales of lubricants) | |

S.J. Palmisano | Ordinary course business with IBM (purchases of consulting and IT maintenance |

Presiding Director

Mr. Palmisano currently serves as ExxonMobil’s Presiding Director. The Presiding Director is selected annually by the other independent members of the Board of Directors. It is normally expected that the same director will serve as Presiding Director for at least two years. The Presiding Director acts as a liaison with the Chairman, in consultation with the other directors.

Specific duties of the Presiding Director include: chairing executive sessions of the non-employee directors and providing feedback from such sessions to the Chairman as appropriate; chairing meetings of the Board in the absence of the Chairman and President; and reviewing in advance and consulting with the Chairman regarding the schedule and agenda for all Board meetings as well as reviewing in advance the materials to be distributed to the directors for Board meetings.

Executive sessions may be convened by the Presiding Director at his or her discretion and will be convened if requested by any other director. Any non-employee director may raise issues for discussion at an executive session.

Board Meetings and Committees; Annual Meeting Attendance

The Board met 10 times in 2007.2008. ExxonMobil’s incumbent directors, on average, attended approximately 9796 percent of Board and committee meetings during 2007;2008; and no director attended less than 75 percent of such meetings. ExxonMobil’s non-employee directors held four executive sessions in 2008.

As specified in our Corporate Governance Guidelines, it is ExxonMobil’s policy that directors should make every effort to attend the annual meeting of shareholders. All incumbent directors attended last year’s meeting except for Dr. Faulkner,Mr. Whitacre, who was first elected to the Board in JanuaryMay 2008.

ExxonMobil’s non-employee directors held five executive sessions of the independent directors in 2007. Normally, the Chair of the Board Affairs Committee (Mr. Shipley) or the Chair of the Compensation Committee (Mr. Howell) presides at executive sessions on a rotational basis, but the non-employee directors may, in light of the subject matter under discussion, select another Presiding Director for a particular session.

The Board appoints committees to help carry out its duties. Board committees work on key issues in greater detail than would be possible at full Board meetings. Only non-employee directors may serve on the Audit, Compensation, Board Affairs, Contributions, and Public Issues and Contributions Committees. Each Committeecommittee has a written charter. The charters are posted on the Corporate Governance section of our Web site and are available free of charge on request to the Secretary at the address given under “Contact Information” on page3.

The table below shows the current membership of each Board committee and the number of meetings each Committeecommittee held in 2007.2008.

| Director | Audit | Compensation | Board Affairs | Contributions | Finance | Public Issues | Executive(1) | Audit | Compensation | Board Affairs | Finance | Public Issues and | Executive(1) | |||||||||||||

M.J. Boskin | Ÿ | Ÿ | Ÿ | Ÿ | Ÿ | |||||||||||||||||||||

L.R. Faulkner | Ÿ | Ÿ | Ÿ | Ÿ | ||||||||||||||||||||||

W.W. George | Ÿ | Ÿ | Ÿ | C | Ÿ | |||||||||||||||||||||

J.R. Houghton | C | Ÿ | Ÿ | C | Ÿ | Ÿ | ||||||||||||||||||||

W.R. Howell | C | Ÿ | Ÿ | |||||||||||||||||||||||

R.C. King | Ÿ | Ÿ | C | Ÿ | C | Ÿ | ||||||||||||||||||||

P.E. Lippincott | Ÿ | Ÿ | Ÿ | |||||||||||||||||||||||

M.C. Nelson | Ÿ | C | Ÿ | Ÿ | Ÿ | Ÿ | Ÿ | |||||||||||||||||||

S.J. Palmisano | Ÿ | Ÿ | Ÿ | Ÿ | Ÿ | |||||||||||||||||||||

S.S Reinemund | Ÿ | Ÿ | Ÿ | Ÿ | ||||||||||||||||||||||

W.V. Shipley | C | Ÿ | C | Ÿ | ||||||||||||||||||||||

R.W. Tillerson | C | C | C | C | ||||||||||||||||||||||

2007 Meetings | 11 | 8 | 6 | 3 | 2 | 4 | 1 | |||||||||||||||||||

E.E. Whitacre, Jr. | Ÿ | Ÿ | ||||||||||||||||||||||||

2008 Meetings | 11 | 7 | 9 | 2 | 4 | 0 | ||||||||||||||||||||

| C | = Chair |

| Ÿ | = Member |

| (1) | Other directors serve as alternate members on a rotational basis. |

Below is additional information about each Board committee.

Board Affairs Committee

The Board Affairs Committee serves as ExxonMobil’s nominating and corporate governance committee. The Committee recommends director candidates, reviews non-employee director compensation, and reviews other corporate governance practices, including the Corporate Governance Guidelines. The Committee also reviews any issue involving an executive officer or director under ExxonMobil’s Code of Ethics and Business Conduct and administers ExxonMobil’s Related Person Transaction Guidelines.

The Committee has adopted Guidelines for the Selection of Non-Employee Directors that describe the qualifications the Committee looks for in director candidates. These Selection Guidelines, as well as the Committee’s charter, are posted on the Corporate Governance section of our Web site.

The Selection Guidelines provide that candidates for non-employee director of ExxonMobil should be individuals who have achieved prominence in their fields, with experience and demonstrated expertise in managing large, relatively complex organizations, and/or, in a professional or scientific capacity, be accustomed to dealing with complex situations preferably with worldwide scope.

A substantial majority of the Board must meet the independence standards described in the Corporation’s Corporate Governance Guidelines, and all candidates must be free from any relationship with

management or the Corporation that would interfere with the exercise of independent judgment. Candidates should be committed to representing the interests of all shareholders and not any particular constituency.

The Board believes a director should be able to serve for several years. Candidates should bring integrity, insight, energy, and analytical skills to Board deliberations, and must have a commitment to devote the necessary time and attention to oversee the affairs of a corporation as large and complex as ExxonMobil. ExxonMobil recognizes that the strength and effectiveness of the Board reflect the balance,

experience, and diversity of the individual directors; their commitment; and importantly, the ability of directors to work effectively as a group in carrying out their responsibilities. ExxonMobil seeks candidates with diverse backgrounds who possess knowledge and skills in areas of importance to the Corporation. The Board must include members with particular experience required for service on key Board committees, as described in the committee charters on our Web site.

The Committee identifies director candidates primarily through recommendations made by the non-employee directors. These recommendations are developed based on the directors’ own knowledge and experience in a variety of fields, and research conducted by ExxonMobil staff at the Committee’s direction. The Committee has also engaged an executive search firm to help the Committee identify new director candidates. The firm identifies potential director candidates for the Committee to consider and helps research candidates identified by the Committee. Additionally the Committee considers recommendations made by the employee directors, shareholders, and others, including search firms. The Committee has the authority to engage consultants to help identify or evaluate potential director nominees.others. All recommendations, regardless of the source, are evaluated on the same basis against the criteria contained in the Selection Guidelines.

Dr. FaulknerMr. Frazier was initially suggested as a candidate by the Chief Executive Officerexecutive search firm, Heidrick & Struggles, and subsequently recommended for nomination by the incumbent non-employee directors on the Board Affairs Committee. The recommendation of Mr. Whitacre was made by the incumbent non-employee directors on the Board Affairs Committee.

Shareholders may send recommendations for director candidates to the Secretary at the address given under “Contact Information” on page3. A submission recommending a candidate should include:

| Ÿ | Sufficient biographical information to allow the Committee to evaluate the candidate in light of the Selection Guidelines; |

| Ÿ | Information concerning any relationship between the candidate and the shareholder recommending the candidate; and, |

| Ÿ | Material indicating the willingness of the candidate to serve if nominated and elected. |

The procedures by which shareholders may recommend nominees have not changed materially since last year’s proxy statement.

The Committee is also responsible for reviewing and making recommendations to the Board regarding the compensation of the non-employee directors. The Committee uses an independent consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

Audit Committee

The Audit Committee oversees accounting and internal control matters. Its responsibilities include oversight of:

| Ÿ | Management’s conduct of the Corporation’s financial reporting process; |

| Ÿ | The integrity of the financial statements and other financial information provided by the Corporation to the SEC and the public; |

| Ÿ | The Corporation’s system of internal accounting and financial controls; |

| Ÿ | The Corporation’s compliance with legal and regulatory requirements; |

| Ÿ | The performance of the Corporation’s internal audit function; |

| Ÿ | The independent auditors’ qualifications, performance, and independence; and, |

| Ÿ | The annual independent audit of the Corporation’s financial statements. |

The Committee has direct authority and responsibility to appoint (subject to shareholder ratification), compensate, retain, and oversee the independent auditors.

The Committee also prepares the report that the SEC rules require be included in the Corporation’s annual proxy statement. This report is on pages 46-47.49-50.

The Committee has adopted specific policies and procedures for pre-approving fees paid to the independent auditors. These policies and procedures, as well as the Committee’s charter, are posted on the Corporate Governance section of our Web site.

The Board has determined that all members of the Committee are financially literate within the meaning of the NYSE standards, and that Dr. Boskin, Dr. Faulkner, Mr. Houghton, Mr. Lippincott, and Mr. Reinemund are “audit committee financial experts” as defined in the SEC rules.

Compensation Committee

The Compensation Committee oversees compensation for ExxonMobil’s senior executives, including their salary, bonus, and incentive awards, and succession plans for key executive positions. The Committee’s charter is available on the Corporate Governance section of our Web site.

During 2007,2008 the Committee established the ceiling for the 20072008 short term and long term incentive award programs;programs, endorsed the salary program for 2008;2009, reviewed the individual performance and contributions of each senior executive;executive, granted individual incentive awards and set salaries for the senior executives;executives, and reviewed progress on executive development and succession planning for senior positions. In addition, the Committee endorsed several program changes as described on page 32.

The Compensation Committee’s report is on page19.

The Committee does not delegate its responsibilities with respect to ExxonMobil’s executive officers and other senior executives (approximately 2425 positions). For other employees, the Committee delegates authority to determine individual salaries and incentive awards to a committee consisting of the Chairman and the Senior Vice Presidents of the Corporation. That committee’s actions are subject to a salary budget and aggregate annual ceilings on cash and equity incentive awards established by the Compensation Committee.

The Committee utilizes the expertise of an external independent consultant, Pearl Meyer & Partners, whom the Committee retains and works with during the year. At the direction of the Chair of the Compensation Committee, the consultant provides the following services:

| Ÿ | Attends meetings of the Compensation Committee. |

| Ÿ | Makes an annual presentation to the Compensation Committee regarding: |

| – | General trends in executive compensation across industries, particularly trends that reflect a change in compensation practices. The consultant advises the Committee on whether changes in compensation practices are relevant to ExxonMobil’s compensation programs. |

| – | A perspective on the structure and competitive standing of ExxonMobil’s compensation program for senior executives. |

| Ÿ | Participates in the Committee’s deliberations regarding compensation for Named Executive Officers that include items such as: |

| – | How to interpret the level of compensation of each Named Executive Officer compared to similar positions across industries. |

| – | The appropriate level of each element of compensation for individual Named Executive Officers considering their career experience and tenure in their positions, as well as general performance of the Company within the industry. |

| – | The pace at which compensation levels should be adjusted over future years. |

| – | How to weigh or consider the impact of a compensation change today on future retirement income. |

| – | The interpretation of issues involving executive compensation raised by shareholders and the appropriate responses from management. |

| – | The relationship between compensation and executive succession planning. |

| – | How the Committee should emphasize or weigh one element of compensation versus another to address the long-term nature of the business and long planning lead times. |

| Ÿ | Prepares the analysis of comparator company compensation used by the Compensation Committee. |

The input of the independent consultant is given serious consideration as part of the Committee’s decision-making process but is not assigned a weight versus the other matters considered by the Committee as described in the “Compensation Discussion and Analysis” beginning on page 19.20.

In addition at the direction of the Chair of the Board Affairs Committee, Pearl Meyer & Partners provides an annual survey of non-employee director compensation for use by that Committee.

ExxonMobil management does not use Pearl Meyer & Partners to advise on ExxonMobil’s general employee compensation and benefit programs. The Chair of the Compensation Committee negotiatesretains sole discretion to hire and fire the independent consultant and to negotiate the terms of Pearl Meyer & Partners’the consultant’s engagement.

The Committee meets with ExxonMobil’s ChairmanCEO and other senior executives during the year to review the Corporation’s business results and progress against strategic plans. The Committee uses this input to help determine the aggregate annual ceilings to be set for the Corporation’s cash and equity incentive award programs. The ChairmanCEO also provides input to the Committee regarding performance assessments for ExxonMobil’s other senior executives and makes recommendations to the Committee with respect to salary and incentive awards for these executives and succession planning for senior positions.

The Committee uses tally sheets to assess total compensation for the Corporation’s senior executives under different scenarios. The tally sheets value all elements of cash compensation; incentive awards, including restricted stock grants; the annual change in pension value; and other benefits and perquisites. The tally sheets also display the value of outstanding awards and lump sum pension estimates. For tally sheet purposes, the Committee considers restricted stock awards on the basis of grant date fair value as shown in the “Grants of Plan-Based Awards” table, not on the financial accounting method used for the “Summary Compensation Table.”

See page 26 pages 28-30for additional information on tally sheets and other analytical tools used by the “Compensation Discussion and Analysis” beginning on page 19 forCommittee to facilitate compensation decisions.

For more information on the Committee’s approach to executive compensation and the decisions made by the Committee for 2007.

Advisory Committee on Contributions

The Advisory Committee on Contributions reviews the level of ExxonMobil’s support for education and other public service programs, including the Company’s contributions2008, refer to the ExxonMobil Foundation. The Foundation works to improve the quality of education in the U.S. at all levels, with special emphasis“Compensation Discussion and Analysis” beginning on math and science. The Foundation also supports the Company’s other cultural and public service giving. The Committee’s charter is available on the Corporate Governance section of our Web site.page 20.

Finance Committee

The Finance Committee reviews ExxonMobil’s financial policies and strategies, including our capital structure, dividends, and share repurchasepurchase program. The Committee authorizes the issuance of corporate debt subject to limits set by the Board. The Committee’s charter is available on the Corporate Governance section of our Web site.

Public Issues and Contributions Committee

The Public Issues Committee and the Advisory Committee on Contributions were combined in 2008. This Committee reviews the effectiveness of the Corporation’s policies, programs, and practices with respect to safety, health, the environment, and social issues. The Committee hears reports

from operating units on safety and environmental activities. The Committeeactivities, and also visits operating sites to observe and comment on current operating practices. In addition the Committee reviews the level of ExxonMobil’s support for education and other public service programs, including the Company’s contributions to the ExxonMobil Foundation. The Foundation works to improve the quality of education in the United States at all levels, with special emphasis on math and science. The Foundation also supports the Company’s other cultural and public service giving. The Committee’s charter is available on the Corporate Governance section of our Web site.

Executive Committee

The Executive Committee has broad power to act on behalf of the Board. In practice the Committee meets only when it is impractical to call a meeting of the full Board.

Shareholder Communications

The Board Affairs Committee has approved and implemented procedures for shareholders and other interested persons to send communications to individual directors, including the Presiding Director, Board Committees, or the non-employee directors as a group.

| Ÿ | Written Communications: Written correspondence should be addressed to the director or directors in care of the Secretary at the address given under “Contact Information” on page3. All correspondence either |

| Ÿ | Electronic Communications: You may |

Code of Ethics and Business Conduct

The Board maintains policies and procedures (which we refer to in this proxy statement as the “Code”) that represent both the code of ethics for the principal executive officer, principal financial officer, and principal accounting officer under SEC rules, and the code of business conduct and ethics for directors, officers, and employees under NYSE listing standards. The Code applies to all directors, officers, and employees. The Code includes a Conflicts of Interest Policy under which directors, officers, and employees are expected to avoid any actual or apparent conflict between their own personal interests and the interests of the Corporation.

The Code is posted on the Corporate Governance section of ourExxonMobil Web site atexxonmobil.com/governance and is available free of charge on request to the Secretary at the address given under “Contact Information” on page3. The Code is also included as an exhibit to ourAnnual Report on Form 10-K. Any amendment of the Code will be posted promptly on our Web site.

The Corporation maintains procedures for administering and reviewing potential issues under the Code, including procedures that allow employees to make complaints without identifying themselves. The Corporation also conducts periodic mandatory business practice training sessions and requires each regular employee and non-employee director to make an annual compliance certification.

The Board Affairs Committee will initially review any suspected violation of the Code involving an executive officer or director and will report its findings to the Board. The Board does not envision that any waiver of the Code will be granted. Should such a waiver occur, it will be promptly disclosed on our Web site.

Related Person Transactions and Procedures

In accordance with SEC rules, ExxonMobil maintains Guidelines for Review of Related Person Transactions. These Guidelines are available on the Corporate Governance section of our Web site.

In accordance with the Related Person Transaction Guidelines, all executive officers, directors, and director nominees are required to identify, to the best of their knowledge after reasonable inquiry, business and financial affiliations involving themselves or their immediate family members that could reasonably be expected to give rise to a reportable related person transaction. Covered persons must also advise the Secretary of the Corporation promptly of any change in the information provided, and will be asked periodically to review and re-affirm their information.

For the above purposes, “immediate family member” includes a person’s spouse, parents, siblings, children, in-laws, and step-relatives.

Based on this information, we review the Company’s own records and make follow-up inquiries as may be necessary to identify potentially reportable transactions. A report summarizing such transactions and including a reasonable level of detail is then provided to the Board Affairs Committee. The Committee oversees the Related Person Transaction Guidelines generally and reviews specific items to assess materiality.

In assessing materiality for this purpose, information will be considered material if, in light of all the circumstances, there is a substantial likelihood a reasonable investor would consider the information important in deciding whether to buy or sell ExxonMobil stock or in deciding how to vote shares of ExxonMobil stock. A director will abstain from the decision on any transactions involving that director or his or her immediate family members.

Under SEC rules, certain transactions are deemed not to involve a material interest (including transactions in which the amount involved in any 12-month period is less than $120,000 and transactions with entities where a related person’s interest is limited to service as a non-employee director). In addition based on a consideration of ExxonMobil’s facts and circumstances, the Committee will presume that the following transactions do not involve a material interest for purposes of reporting under SEC rules:

| Ÿ | Transactions in the ordinary course of business with an entity for which a related person serves as an executive officer,provided(1) the affected director or executive officer did not participate in the decision on the part of ExxonMobil to enter into such transactions; and, (2) the amount involved in any related category of transactions in a 12-month period is less than 1 percent of the entity’s gross revenues. |

| Ÿ | Grants or membership payments in the ordinary course of business to nonprofit organizations,provided(1) the affected director or executive officer did not participate in the decision on the part of ExxonMobil to make such payments; and, (2) the amount of general-purpose grants in a 12-month period is less than 1 percent of the recipient’s gross revenues. |

| Ÿ | Payments under ExxonMobil plans and arrangements that are available generally to U.S. salaried employees (including contributions under ExxonMobil’s Educational and Cultural Matching Gift Programs and payments to providers under ExxonMobil health care plans). |

| Ÿ | Employment by ExxonMobil of a family member of an executive officer,providedthe executive officer does not participate in decisions regarding the hiring, performance evaluation, or compensation of the family member. |

Transactions or relationships not covered by the above standards will be assessed by the Committee on the basis of the specific facts and circumstances.

The following disclosures are made as of February 25, 2009, the date of the most recent Board Affairs Committee review of potential related person transactions.

ExxonMobil and its affiliates have about 81,00080,000 employees around the world and employees related by birth or marriage may be found at all levels of the organization. Two currentretired executive officers have family members who are also employed by the Corporation: J.S. Simon (Senior(formerly Senior Vice President and Director) has a son-in-law who works for ExxonMobil Fuels Marketing Company, and H.H. Hubble (Vice(formerly Vice President, Investor Relations and Secretary) has a son who works for ExxonMobil Development Company.

ExxonMobil employees do not receive preferential treatment by reason of being related to an executive officer, and executive officers do not participate in hiring, performance evaluation, or compensation decisions for family members. ExxonMobil’s employment guidelines statestate: “Relatives of Company employees may be employed on a non-preferential basis. However an employee should not be employed by or assigned to work under the direct supervision of a relative, or to report to a supervisor who in turn reports to a relative of the employee.” Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider the relationships noted above to be material within the meaning of the related person transaction disclosure rules.

P.T. Mulva (Vice President and Controller) has a brother currently serving as Chairman and CEO of ConocoPhillips. As is the case with most other major companies in the oil and gas industry, ExxonMobil has a variety of business transactions with ConocoPhillips. These transactions include routine purchases and sales of crude oil, petroleum products, and pipeline transportation capacity. Affiliates of ExxonMobil and ConocoPhillips have joint ownership of a refinery in Germany and a number of pipelines, terminals, emergency response companies, and service companies, and also have undivided interests in a variety of exploration, development, and production projects. All of these transactions are entered into in the ordinary course of business without influence from P.T. Mulva. Neither P.T. Mulva nor, to our knowledge after reasonable inquiry, his brother, has any interest in these transactions different from the general interest of other employees and shareholders. Accordingly, consistent with ExxonMobil’s Related Person Transaction Guidelines, we do not consider these transactions to be material within the meaning of the related person transaction disclosure rules.

S.R. LaSala (Vice President and General Tax Counsel) has a son who is a partner of a law firm that performs work for ExxonMobil. Mr. LaSala is not involved in decisions to retain the firm, and, therefore, we do not consider the relationship to be material within the meaning of the related person transaction disclosure rules.

S.J. Glass, Jr. (Vice President) has a brother who is a partner of a law firm that performs work for ExxonMobil. Mr. Glass is not involved in decisions to retain the firm, and, therefore, we do not consider the relationship to be material within the meaning of the related person transaction disclosure rules.

The Board Affairs Committee also reviewed ExxonMobil’s ordinary course business with companies for which non-employee directors serve as executive officers and determined that, in accordance with the categorical standards described above, none of those matters represent reportable related person transactions. See “Director Independence” on page4.

We are not aware of any related person transaction required to be reported under applicable SEC rules since the beginning of the last fiscal year where our policies and procedures did not require review, or where such policies and procedures were not followed.

The Corporation’s Related Person Transaction Guidelines are intended to assist the Corporation in complying with its disclosure obligations under SEC rules. These procedures are in addition to, not in lieu of, the Corporation’s Code of Ethics and Business Conduct.

ITEM 1 –ELECTION– ELECTION OF DIRECTORS

The Board of Directors has nominated the director candidates named on the following pages. Personal information on each of our nominees is also provided. All of our nominees currently serve as ExxonMobil directors except Mr. Whitacre,Frazier, who has been nominated by the Board for first election as a director at the annual meeting. Dr. Faulkner was elected by the Board in January 2008. Messrs. Howell, Lippincott, and Simon have reached retirement age and are not standing for re-election. Messrs. Houghton and Shipley, havewho previously reached the usual retirement age, but are not standing for re-election on an exception basis at the request of the Board.this year.

If a director nominee becomes unavailable before the election, your proxy authorizes the people named as proxies to vote for a replacement nominee if the Board names one.

The Board recommends you vote FOR each of the following candidates:

Michael J. Boskin

Age Director since 1996 | Principal Occupation: T.M. Friedman Professor of Economics and Senior Fellow, Hoover Institution, Stanford University

Public Company Directorships: | |

Larry R. Faulkner

Age Director since 2008 | Principal

Public Company | |

Kenneth C. Frazier

Age 54 Director nominee | Principal Occupation: Executive Vice President and President, Global Human Health, Merck & Co. Business Experience: Mr. Frazier was elected Executive Vice President and President, Global Human Health, at Merck in 2007, and Executive Vice President and General Counsel in 2006. He served as Senior Vice President and General Counsel at Merck from 1999 to 2006. Public Company Directorships: None | |

William W. George

Age Director since 2005 | Principal Occupation: Professor of Management Practice, Harvard University

Public Company Directorships: Goldman | |

|

| |

Reatha Clark King

Age Director since 1997 | Principal

| |||

Marilyn Carlson Nelson

Age Director since 1991 | Principal

Company | |||

Samuel J. Palmisano

Age Director since 2006 Presiding Director since 2008 | Principal

Public Company | |||

Steven S Reinemund

Age Director since 2007 | Principal Occupation:

Public Company Directorships: | |

|

| |

Rex W. Tillerson

Age Director since 2004 | Principal

Public Company | |

Edward E. Whitacre, Jr.

Age Director | Principal

Public Company Directorships: Burlington Northern Santa | |

Director compensation elements are designed to:

| Ÿ | Ensure alignment with long-term shareholder interests; |

| Ÿ | Ensure the Company can attract and retain outstanding director candidates who meet the selection criteria outlined in the Guidelines for Selection of Non-Employee Directors, which can be found |

| Ÿ | Recognize the substantial time commitments necessary to oversee the affairs of the Corporation; and, |

| Ÿ | Support the independence of thought and action expected of directors. |

Non-employee director compensation levels are reviewed by the Board Affairs Committee each year, and resulting recommendations are presented to the full Board for approval. The Committee uses an independent consultant, Pearl Meyer & Partners, to provide information on current developments and practices in director compensation. Pearl Meyer & Partners is the same consultant retained by the Compensation Committee to advise on executive compensation, but performs no other work for ExxonMobil.

ExxonMobil employees receive no extraadditional pay for serving as directors.

Non-employee directors receive compensation consisting of cash and equity in the form of restricted stock.

In 2007, the base cash retainer for non-employee directors was $75,000 per year. Members of the Audit and Compensation Committees received a fee of $15,000 per year, and the Chairs of those Committees received an additional fee of $10,000 per year. For other Committees, non-employee directors received $8,000 per year for each Committee on which they served, and the Chairs received an additional fee of $7,000 per year.

Effective January 1, 2008, non-employee director cash compensation was restructured to pay a higher base fee of $100,000 per year and to eliminate per committee and committee chair fees except for the Chairs of the Audit and Compensation Committees ($10,000).

Through 2007, non-employee directors could defer all or part of their cash compensation either in ExxonMobil notional stock with dividend equivalents, or in a deferred account earning interest at the prime rate. As of year-end 2007, the ability to defer director fees has been terminated. Accrued deferred account balances are being returned to participants in one or two annual installments that commenced in January 2008.

No fees are paid to members of the Executive Committee. Non-employee directors are also reimbursed for reasonable expenses incurred to attend board meetings or other functions relating to their responsibilities as a director of Exxon Mobil Corporation.

In additionThe annual cash retainer for non-employee directors is $100,000 per year. Committee and Committee Chair fees were eliminated in 2007, except for the Chairs of the Audit and Compensation Committees (who receive an additional $10,000 per year). The purpose of this change was to simplify the fees described above, we pay anon-employee director compensation package.

As of year-end 2007, the program in which non-employee directors could defer their cash compensation was terminated. Accrued deferred account balances were returned to participants in one or two annual installments that commenced in January 2008.

A significant portion of director compensation is paid in restricted stock to strongly align director compensation with the long-term interests of shareholders. Through 2007, each incumbent non-employee director except for Dr. Faulkner, who was first elected to the Board in January 2008, received an annual award of 4,000 shares of restricted stock. Effective January 1, 2008, theThe annual restricted stock award grant was reduced from 4,000 shares tofor incumbent non-employee directors is 2,500 to maintain alignment with equity compensation paid by comparator companies. In addition, eachshares. A new non-employee director receives a one-time grant of 8,000 shares of restricted stock upon first being elected to the Board.

While on the Board, the non-employee director receives the same cash dividends on restricted shares as a holder of regular common stock, but the non-employee director is not allowed to sell the shares. The restricted shares may be forfeited if the non-employee director leaves the Board early, i.e., before retirement age of 72, as specified for non-employee directors.

Current and former non-employee directors of Exxon Mobil Corporation are eligible to participate in the ExxonMobil Foundation’s Educational and Cultural Matching Gift Programs under the same terms as the Corporation’s U.S. employees.

Director Compensation for 20072008

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(a) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Earnings ($)(b) | Other Compensation ($)(c) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(a) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Earnings ($) | Other Compensation ($)(b) | Total ($) | ||||||||||||||

M.J. Boskin | 104,182 | 298,540 | 0 | 0 | 0 | 318 | 403,040 | 100,000 | 234,163 | 0 | 0 | 0 | 350 | 334,513 | ||||||||||||||

L.R. Faulkner | 92,033 | 687,280 | 0 | 0 | 0 | 350 | 779,663 | |||||||||||||||||||||

W.W. George | 106,000 | 298,540 | 0 | 0 | 0 | 318 | 404,858 | 105,934 | 234,163 | 0 | 0 | 0 | 350 | 340,447 | ||||||||||||||

J.R. Houghton | 111,297 | 298,540 | 0 | 0 | 0 | 318 | 410,155 | 110,000 | 234,163 | 0 | 0 | 0 | 350 | 344,513 | ||||||||||||||

W.R. Howell | 114,181 | 298,540 | 0 | 0 | 24,198 | 318 | 437,237 | 44,725 | 234,163 | 0 | 0 | 0 | 350 | 279,238 | ||||||||||||||

R.C. King | 112,999 | 298,540 | 0 | 0 | 4,830 | 318 | 416,687 | 100,000 | 234,163 | 0 | 0 | 0 | 350 | 334,513 | ||||||||||||||

P.E. Lippincott | 101,297 | 298,540 | 0 | 0 | 0 | 318 | 400,155 | 40,659 | 234,163 | 0 | 0 | 0 | 350 | 275,172 | ||||||||||||||

H.A. McKinnell | 40,798 | 298,540 | 0 | 0 | 3,909 | 318 | 343,565 | |||||||||||||||||||||

M.C. Nelson | 106,000 | 298,540 | 0 | 0 | 0 | 318 | 404,858 | 100,000 | 234,163 | 0 | 0 | 0 | 350 | 334,513 | ||||||||||||||

S.J. Palmisano | 106,000 | 298,540 | 0 | 0 | 0 | 318 | 404,858 | 100,000 | 234,163 | 0 | 0 | 0 | 350 | 334,513 | ||||||||||||||

S.S Reinemund | 57,615 | 387,357 | 0 | 0 | 0 | 318 | 445,290 | 100,000 | 510,846 | 0 | 0 | 0 | 350 | 611,196 | ||||||||||||||

W.V. Shipley | 104,181 | 298,540 | 0 | 0 | 0 | 318 | 403,039 | 100,000 | 234,163 | 0 | 0 | 0 | 350 | 334,513 | ||||||||||||||

E.E. Whitacre, Jr. | 59,341 | 418,670 | 0 | 0 | 0 | 350 | 478,361 | |||||||||||||||||||||

| (a) | In accordance with SEC rules, the valuation of stock awards in this table represents the compensation cost of awards recognized for financial statement purposes for |

| Each director (other than Dr. Faulkner and Mr. |

| Dr. Faulkner received a one-time grant of 8,000 restricted shares upon being first elected to the Board in January 2008. The compensation cost recognized for this award and shown in the table for 2008 is the same as the grant date fair value of this grant, which was $687,280. |

| Mr. Reinemund received a one-time grant of 8,000 restricted shares upon being first elected to the Board in May 2007. The compensation cost recognized for this award and shown in the table for 2008 is five-twelfths of the grant date fair value of this grant in 2007, which was $276,683. |

| Mr. Whitacre received a one-time grant of 8,000 restricted shares upon being first elected to the Board in May 2008. The compensation cost recognized for this award and shown in the table for 2008 is seven-twelfths of the grant date fair value of this grant |

| At year-end |

| Name | Restricted Shares (#) | |

M.J. Boskin | ||

L.R. Faulkner | 8,000 | |

W.W. George | ||

J.R. Houghton | ||

| ||

R.C. King | ||

| ||

M.C. Nelson | ||

S.J. Palmisano | ||

S.S Reinemund | ||

W.V. Shipley | ||

E.E. Whitacre, Jr. | 8,000 |

| (b) |

| The amount shown for each director is the prorated cost of travel accident insurance covering death, dismemberment, |

The non-employee directors are not entitled to any additional payments or benefits as a result of leaving the Board or death except as described above. The non-employee directors are not entitled to any payments or benefits resulting from a change in control of the Corporation.

DIRECTOR AND EXECUTIVE OFFICER STOCK OWNERSHIP

These tables show the number of ExxonMobil common stock shares each executive named in the “Summary Compensation Table” on page 3335 and each non-employee director or director nominee owned on February 29, 200828, 2009 (or at retirement, if earlier). In these tables, ownership means the right to direct the voting or the sale of shares, even if those rights are shared with someone else. None of these individuals owns more than 0.020.03 percent of the outstanding shares.

| Named Executive Officer | Shares Owned | Shares Covered by Exercisable Options | Shares Owned | Shares Covered by Exercisable Options | ||||||

R.W. Tillerson | 929,149 | (1) | 327,307 | 1,131,520 | (1) | 327,307 | ||||

D.D. Humphreys | 433,346 | (2) | 195,097 | 518,127 | (2) | 175,097 | ||||

S.R. McGill | 909,833 | (3) | 345,097 | |||||||

H.R. Cramer | 671,613 | 458,000 | ||||||||

C.W. Matthews | 525,742 | 110,000 | ||||||||

S.D. Pryor | 712,421 | (3) | 508,000 | |||||||

J.S. Simon | 826,283 | (4) | 470,000 | 833,685 | (4) | 462,705 | ||||

H.R. Cramer | 607,492 | 529,964 | ||||||||

M.E. Foster | 496,169 | (5) | 215,097 | 496,673 | (5) | 215,097 | ||||

P.E. Sullivan | 432,973 | (6) | 309,943 | |||||||

| (1) | Includes |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes 11,177 shares jointly owned with spouse. |

| (5) | Includes |

| Non-Employee Director/Nominee | Shares Owned | ||

M.J. Boskin | |||

L.R. Faulkner | |||

K.C. Frazier | 0 | ||

W.W. George | (1) | ||

J.R. Houghton | (2) | ||

| (3) | ||

| (4) | ||

| |||

| |||

S.J. Palmisano | |||

S.S Reinemund | |||

W.V. Shipley | |||

E.E. Whitacre, Jr. |

| (1) | Includes 10,000 shares held as co-trustee of family foundation. |

| (2) | Includes 5,000 shares owned by spouse. |

| (3) | Includes |

| Includes 18,000 shares held as co-trustee of family trusts. |

| Includes |

On February 29, 2008,28, 2009, ExxonMobil’s incumbent directors and executive officers (27 people) together owned 6,876,8916,979,421 shares of ExxonMobil stock and 3,577,3502,401,119 shares covered by exercisable options, representing about 0.200.19 percent of the outstanding shares.

Section 16(a) Beneficial Ownership Reporting Compliance

The Compensation Committee of the Board of Directors has reviewed and discussed the “Compensation Discussion and Analysis” for 20072008 with management of the Corporation. Based on that review and discussion, we recommended to the Board that the “Compensation Discussion and Analysis” be included in the Corporation’s proxy statement for the 20082009 annual meeting of shareholders, and also incorporated by reference in the Corporation’sAnnual Report on Form 10-K for the year ended December 31, 2007.2008.

| William | ||

| Samuel J. Palmisano | ||

| Reatha Clark King | Edward E. Whitacre, Jr. |

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis and Executive Compensation Tables are organized as follows:

Overview

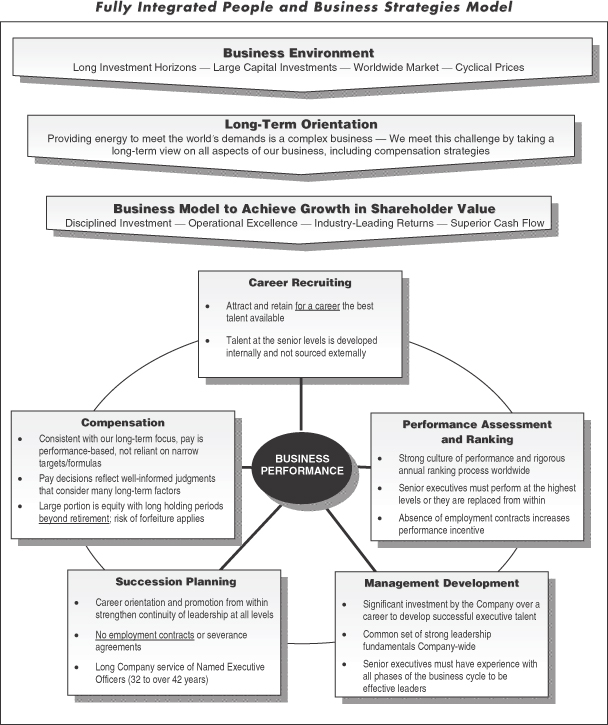

Providing energy to meet the world’s demands is a complex business. We meet this challenge by taking a long-term view rather than reacting to short-term business cycles. The compensation program of ExxonMobil aligns with and supports the long-term business fundamentals and core business strategies as outlined below.below and illustrated in the model on page 23.

| Ÿ | Long investment horizons; |

| Ÿ |

|

| Ÿ | Worldwide |

| Ÿ | Commodity-based, cyclical |

| Ÿ | Long-term growth in shareholder value; |

| Ÿ | Disciplined, selective, and long-term focus in making investments; |

| Ÿ | Operational excellence; and, |

| Ÿ | Industry-leading returns on capital and superior cash flow. |

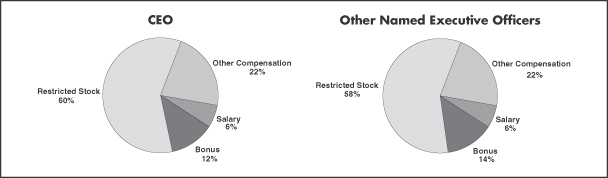

Key Elements of the Compensation Program

The key elements of our compensation program and staffing objectives that support thesethe business fundamentals and strategies are:

| Ÿ | Long-termcareer orientation with high individual performance standards (see |

| Ÿ | Basesalary that rewards individual experience and performance (see page |

| Ÿ | Annualbonus grants based on business performance, as well as individual experience and performance (see pages |

| Ÿ | Payment of a large portion of executive compensation in the form ofequity with long mandatory holding periodsthat extend beyond retirement (see pages |

| Ÿ | Retirement benefits (pension and savings plans) that provide for financial security after employment (see |

Other Supporting Compensation and Staffing PrinciplesPractices

| Ÿ | Executives are “at-will” employees of the Company. Theydo not have employment contracts, |

| Ÿ | A strong program ofmanagement development and succession planning is in place to reinforce a career orientation and provide continuity of |

| Ÿ | Inappropriate risk-taking is discouraged by requiring senior executives to hold a substantial portion of their equity incentive award for their entire careerand beyond retirement. |

| Ÿ | All U.S. executives, including the CEO, the other Named Executive Officers, and about 1,200 other U.S. executives, participate incommon programs (the same salary, incentive and retirement programs). Within these programs, the compensation of executives is differentiated based on |

| Ÿ | No tax assistance is provided by the Company on any elements of executive officer compensation or perquisites other than relocation. The relocation policy is a broad-based program that applies to all transferred U.S. professional and executive employees. |

| Ÿ | Substantial amounts of executive compensation are atrisk of forfeiture in case of detrimental activity, unapproved early termination, or material negative restatement of financial or operating results. |

| Ÿ | The Companydoes not reprice equity incentive awards. The utilization of restricted stock instead of stock options and the determination of annual grants on a share-denominated versus price basis help reinforce this practice. |

| Ÿ | Equity compensation is not included in pension calculations. |

Business Performance and Basis for Compensation Decisions

| Ÿ | Compensation decisions are based on the results achieved in the following areas over multiple year periods: |

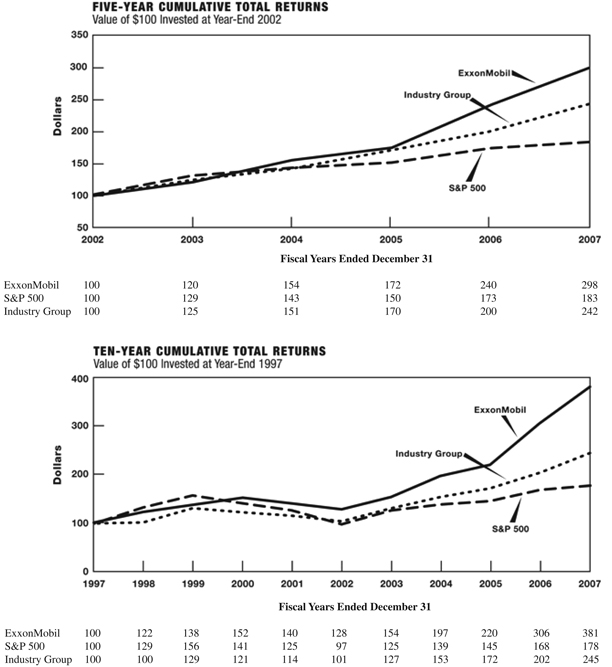

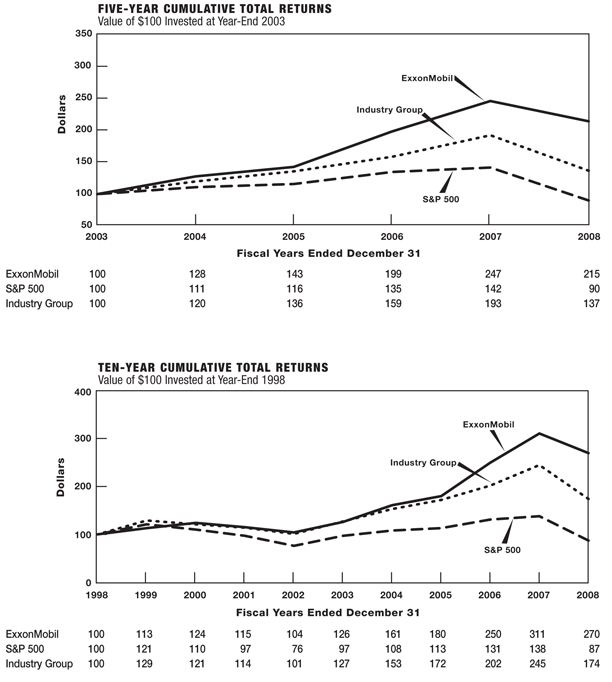

| – | Total shareholder return; |

| – | Net income; |

| – | Return on capital employed; |

| – | Cash returned to shareholders; |

| – | Safety, health, and environmental performance; |

| – | Operating performance of the Upstream, Downstream, and Chemical segments; |

| – | Business controls; and, |

| – |

|

| Ÿ | Thedecision-making process with respect to compensation requires judgment, taking into account business and individual performance and responsibility.Quantitative targets or formulas are not used to assess individual performance or determine the amount of compensation. The Compensation Committee assesses the results described above against a broad range of goals and objectives and takes into consideration multiple external factors that influence these results. |

| Ÿ | The disclosure regulations result in a roster of Named Executive Officers different from the most senior management team leading the Company, which is referred to as the Management Committee. |

| Ÿ | The Management Committee comprises the following: |

| – | Chairman and |

| – | Senior Vice Presidents |

| – | D.D. Humphreys; |

| – | M.W. Albers, |

| – | M.J. Dolan, who replaced J.S. Simon upon his retirement in 2008; and, |

| – | A.P. Swiger, effective April 2009. |

| Ÿ | All members of the Management Committee are shown as Named Executive Officers except for |

|

| Ÿ | Although each member of the Management Committee is responsible for specific business activities, together they share responsibility for the performance of the Company. |

People and Business Strategies Model

The following summary illustrates how the compensation and executive development strategies support and integrate with ExxonMobil’s business model. This integrated approach supports long-termgrowth in shareholder value.

Key Elements of the Compensation Program

| Ÿ | It is our objective to attract and retain for a career the best talent available. |

| Ÿ | It takes a long period of time and a significant investment to develop the experienced executive talent necessary to succeed in the oil and gas business; senior executives must have experience with all phases of the business cycle to be effective leaders. |

| Ÿ | Career orientation among a dedicated and highly skilled workforce, combined with the highest performance standards, contributes to the Company’s leadership in the industry and serves the interests of shareholders in the long term. |

| Ÿ | The long Company service of executive officers reflects this strategy at all levels of the organization. |

| – | The Named Executive Officers have career service ranging from |

| – | The |

| Ÿ | Consistent with our long-term career orientation, high-performing executives typically earn substantially higher levels of compensation in the final years of their careers than in the earlier years. |

| – | This pay practice reinforces the importance of a long-term focus in making decisions that are key to business success. |

| – | Because the compensation program emphasizes individual experience and long-term performance, executives holding similar positions may receive substantially different levels of compensation. |

| Ÿ | Salaries provide executives with a base level of income. |

| Ÿ | The level of annual salary is based on the executive’s responsibility, performance assessment, and career experience. |

| Ÿ | Salary decisions directly affect the level of retirement benefits since salary is included in retirement-benefit formulas. The level of retirement benefits is, therefore, performance-based like |

| Ÿ | The annual bonus program is highly variable depending on annual financial and operating results. |

| Ÿ | The size of the annual bonus pool is based on the annual net income of the Company and other business performance factors as described |

| Ÿ | In setting the size of the annual bonus pool and individual executive awards, the Compensation Committee: |

| – | Secures input from the Chairman on the performance of the Company and from the Compensation Committee’s external consultant regarding compensation trends across industries. |

| – | Uses judgment to |

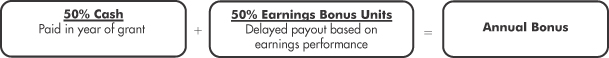

| Ÿ | The annual bonus program incorporates unique elements to further reinforce retention and recognize performance. Awards under this program are generally delivered as: |

|

|

|

|

|

| Ÿ | Earnings Bonus Units are cash awards that are tied to future cumulative earnings per share. Earnings Bonus Units pay out when a specified level of cumulative earnings per share is achieved or within three years. |

| – | For bonus awards granted in |

| – | If cumulative earnings per share do not reach |

| – | The intent of the earnings per share trigger is to tie the timing of the bonus payment |

| – | Prior to payment, the delayed portion of a bonus may be forfeited if the executive leaves the Company before the standard retirement age, or engages in activity that is detrimental to the Company. |

| – | Cash and Earnings Bonus Unit payments are subject torecoupment in the event of material negative restatement of the Corporation’s reported financial or operating results. |

| Ÿ | The |

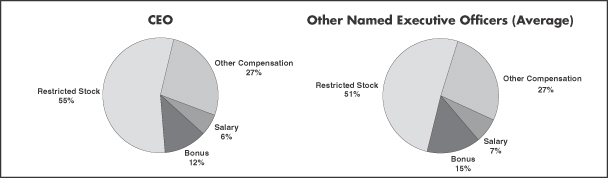

| Ÿ | Equity compensation accounts for a substantial portion of total compensation to align the personal financial interests of executives with the long-term interests of shareholders. |

| Ÿ | It is the objective to grant 50 to 70 percent of a senior executive’s total compensation in the form of restricted stock as measured by grant date fair market value, as described beginning on page |

Rationale

| Ÿ | Given the long-term orientation of our business, granting equity in the form of restricted stock with long vesting provisions keeps executives focused on the fundamental premise that decisions made currently affect the performance of the Corporation and Company stock many years into the future. |

| Ÿ | This practice supports a risk/reward profile that reinforces a long-term view, which is fundamental to the |

| Ÿ | Restricted stock removes employee discretion on the sale of Company-granted stock holdings and reinforces the retention objectives of the compensation program. |

Restriction Periods

| Ÿ | The |

| – | 50 percent of each grant is restricted for five years; and, |

| – | The balance is restricted for 10 years or until retirement,whichever is later. |

| Ÿ | The long restriction |

|

|

| Ÿ | For the most senior executives, more than half of the total amount of restricted stockmay not be sold or transferred until after the executive |

| Ÿ | The restricted period for stock awards is not subject to acceleration, except in the case of death. |

Forfeiture Risk and Hedging Policy

| Ÿ | Restricted stock is subject to forfeiture if an executive: |

| – | Leaves the Company before standard retirement time (defined as age 65 for U.S. employees). In the event of early retirement prior to the age of 65 (i.e., age 55 to 64), the Compensation Committee must approve the retention of awards by an executive officer. |

| – | Engages in activity that is detrimental to the Company, even if such activity occurs or is discovered after retirement. |

| Ÿ | Company policy prohibits all employees, including executives, from entering into put or call options |

Share Utilization

| Ÿ | The Compensation Committee establishes a ceiling each year for annual stock awards. The overall number of shares granted in the restricted stock program in |

| Ÿ | The Company has a |

Prior Stock Programs

| Ÿ | All equity awards granted since 2003 are granted under the Corporation’s 2003 Incentive Program. All equity-based awards (including stock options and restricted stock) granted prior to 2003 that remain outstanding were granted under the Corporation’s 1993 Incentive Program (other than awards granted by Mobil Corporation prior to the merger). No further grants can be made under the 1993 Incentive Program. |

| Ÿ | Prior to 2002, ExxonMobil granted Career Shares to the Company’s most senior executives. |

| – | Career Shares |

| – | The Corporation ceased granting Career Shares in 2002 when the Corporation began granting restricted stock to the broader executive population in lieu of stock options. |

| – | Restricted stock and long mandatory holding periods achieve the same objectives as Career Shares and therefore it is unnecessary to grant both Career Shares and the current form of restricted stock. |

| – | Career Shares could be granted again in the future under the Corporation’s 2003 Incentive Program, but there are no current plans to make such grants. |

| Ÿ | Before the merger, Mobil Corporation granted retention awards under the former Mobil Corporation Management Retention Plan. Retention awards are stock units that settle in cash in a single lump sum |

payment as soon as practicable after retirement (taking into account the required six-month delay in payment required under the American Jobs Creation Act of 2004). Messrs. Cramer and Pryor have outstanding retention awards. |

Stock Ownership

| Ÿ | The table below shows |

| ||

| ||

| ||

| ||

| ||

| ||

|

|

| Name | Dollar Value of Stock Ownership as a Multiple of Salary | Percent of Shares Restricted | ||

R.W. Tillerson | 48 | 89% | ||

D.D. Humphreys | 45 | 84% | ||

H.R. Cramer | 64 | 69% | ||

C.W. Matthews | 49 | 72% | ||

S.D. Pryor | 61 | 68% | ||

All Other Executive Officers (average) | 35 | 74% |

Common Programs

| Ÿ | Senior executives participate in the same tax-qualified pension and savings plans as most other U.S. employees. Senior executives also participate in the same nonqualified defined benefit and defined contribution plans as other U.S. executives. |

| Ÿ | A key principle on which the pension and savings programs are based is commonality of design for all employees, except where the American Jobs Creation Act of 2004 requires delayed timing of nonqualified plan distributions for higher-level executives. The same principle of commonality applies to the Company health care benefits (see page |

Pension Plans

| Ÿ | The tax-qualified and nonqualified pension plans, described in more detail beginning on page |

| Ÿ | Pay for |

| Ÿ | Bonus includes the amounts that are paid at grant and the amounts delayed by the Company, as described beginning on page |

| Ÿ | The portion of annual bonus subject to delayed payment is not intended to be at risk and therefore is included for pension purposes in the year of grant rather than the year of payment, as described on page |

| Ÿ | Pension benefits are paid upon retirement as follows: |

| – | Qualified pension plan benefits are payable, at the election of the employee, in a lump sum or in one of various forms of annuity payments. |

| – | Nonqualified pension planbenefits are paid in the form of an equivalent lump sum six months after retirement. |

Qualified Savings Plan

| Ÿ | The qualified savings plan described on page |

| Ÿ | To receive the Company-matching contribution, employees must contribute a minimum of 6 percent of salary. |

| Ÿ | Qualified benefits are payable in a single lump sum or in partial withdrawals at any time after retirement. |

| Ÿ | The Code generally requires distributions to commence after the employee has attained age 70-1/2. |

Nonqualified Savings Plan

| Ÿ | The nonqualified savings plan described on pages |

|

| Ÿ | The nonqualified savings plan balance is paid in a single lump sum six months after retirement. |

Basis of Compensation Decision-Making ProcessCommittee Decisions

The Committee sets the compensation for the Named Executive Officers and certain other senior executives. The following describes the basis on which the Committee made decisions in 2008.

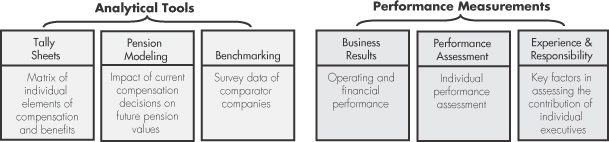

The Compensation Committee used the analytical tools described below to facilitate the compensation decisions made in 2007.

| Ÿ | A tally sheet is a matrix used by the Compensation Committee that shows the individual elements of compensation and benefits for each Named Executive Officer. The total of all compensation and benefit plan elements is included to reflect the full employment costs for each Named Executive Officer. |

| Ÿ | For tally sheet purposes, the Compensation Committee values restricted stock based on fair market value at the date of grant, which equals the number of shares multiplied by the grant price. This is different from the restricted stock values in the “Summary Compensation Table,” which, as required by current disclosure rules, are based on the expensing of outstanding restricted stock under Statement of Financial Accounting Standards No. 123, as revised (FAS 123R). |

| Ÿ | Tally sheets were used for the following principal purposes: |

| – | To understand how decisions on each individual element of compensation |